Tax Under The International Tax Regime

Direct Tax under the International Tax regime

Income tax is a form of direct tax and forms a very

A broad variety of tax. This is taxed on an individual or a Hindu Undivided Family or any taxpayer other than companies, pay on the income received. The law prescribes the rate at which such income should be taxed. A great part of income tax also comes from cross-border transactions, expatriate employees and even NRIs. This type of tax forms part of the larger sub-set of international taxation or cross-border taxation.

Tax on NRI

Residential status of a person describes the taxability of that person in a county but in the case of Non-resident only that Income which is received or deemed to have been received in

India by or on his behalf and income that accrues or arises or is deemed to accrue or arising in India is Taxable in India.

Section 9 of the Income Tax Act, 1961 envisages certain provisions.

As per the section, the following Incomes will be deemed to accrue or arise in India, even though they may actually accrue or arise out of India :-

- Income from Business Connection in India.

- Income from any Property, Asset or Source of Income in India.

- Capital Gains from transfer of any Capital Asset situated in India.

- Income from Salary earned in India – i.e. if Service is rendered in India. Where a rest period which is preceded or succeeded by services rendered in India forms part of the service contract of employment, the same shall be considered to be income earned in India.

- Income from salary (other than perquisite &/or allowance ) paid by Government of

India to an Indian Citizen of India even though the service is rendered out of India.

- Dividend paid by Indian Company outside India.

- Income by way of Interest in some situations.

- Income by way of Royalty in some situations.

- Income by way of Fees for Technical Services in some situations.

Thus a NRI is expected to pay tax according to the provisions of the act for any part of his or her income that is accrues through the above mentioned ways.

NRI’s are taxed as per income tax slabs applicable to resident Indians below the age of 60 years irrespective of the age criteria of non-resident Indian. Simply means that if the NRI is above the age of 60 years still he will be taxed a per tax rate applicable to resident Indian who is below the age of 60 years.

But, in the following cases NRIs need not to file tax return:

- If taxable income consists of only investment income or long term capital gains.

- When the tax has already been deducted at source, on such income.

- Interest earned on Saving Certificates etc.

- Interest earned on Non Resident (Non-repatriable) [NRNR] Deposit.

- Interest on notified bonds.

- interest earned on Foreign Currency Non Resident (Bank) [FCNR(B)] Deposit which technically is exempt under Section 10(4)(ii) too being covered by the definition of an NRE deposit under the FERA 1973 in case of a †Non-Resident †or “Resident but Not Ordinarily Resident†as per the provisions of Income Tax Act, 1961.

- Dividend income from Indian Public/Private Company, Indian Mutual Fund and from Unit Trust of India is exempt from tax in India at par with residents.

- Long-term capital gains arising on transfer of equity shares traded on recognized Stock Exchange and units of equity schemes of Mutual Fund is exempt from tax at par with residents, provided Security transaction tax is paid.

- Remuneration or fee received by non-resident / non-citizen / citizen but not ordinarily resident ‘consultants’, for rending technical consultancy in India under approved programme including remuneration of their employees, and income of their family members which accrue or arise outside India.

Since the Income tax act makes it compulsory for the NRI to pay tax it further makes provision to avoid double taxation. Double taxation may accur when the country where the NRI is residing may ask for the tax on the transactions mentioned in Section 9 of the Act.

For this an agreement is signed between both the countries. Double Taxation Avoidance Agreement (DTAA) is an agreement signed between two countries/nations for resolving the issues of taxability of income and increased transparency to avoid tax evasion. The provisions

of Double Taxation Avoidance Agreement have been entered into the Section 90 of the

Income Tax Act, 1961 in conformity with the Central Government. In case, where there are

no specific provisions given by the agreement, the provisions of Income tax Act will be

applicable.

Presently, India has the DTAA with more than 88 countries. This states that if a NRI is a resident in any of those 88 countries and he/she is paying taxes on income earned then he will be eligible for a tax benefit in either of the following two ways:

- Exemption method: under this method, any one country will tax the income of NRI. Means if the income is taxed in India then the same income will not be taxed in his own country.

- Credit method: under this method, both the countries will tax the income of that person but the country where he is a resident will allow him deduction or give credit to the foreign tax. Section 11(5)d, Section 11(5)e Section 11(5)f of the Act lay down the provisions to determine what would constitute as the taxable income of the NRIs.

There is no different law for studying international taxation. There is no separate courts for the matters related to international taxation.

Tax on expatriate Employees

There is no specific definition of the term as per the Income Tax Act, 1961, so we must rely on the general meaning of the word. A person living in a country other than his or her country of citizenship, often temporarily and for work reasons. The person takes a position outside his or her home country, either independently or as a work-related assignment arranged by the employer, which can be a university, company, non-governmental organisation, or government.

When it comes to taxation Residential status of a person is determined on the basis of the physical presence in India and as per Section 6 of the Income Tax Act. For the taxation of expatriates, the residential status has to be determined as per the Income Tax Act as well as the Double Taxation Avoidance Agreement.

If an expatriate person is falling in the category of a resident the whole income will be taxable. If he is a “Not ordinary resident” then income received and sourced in India along with income from business controlled in India will be taxed. If he is an NRI then the income mentioned in above section will be taxed.

At times, an expat employee may be a resident of both the countries under the taxation laws of respective countries. Under such situation, ‘Tie Breaker Rule’ as mentioned in the Treaty has to be applied to determine his residential status. The factors to be considered for this are as follows:-

| Factors | Description |

| (i) Permanent home | The country in which he/she has a permanent home available to him/her |

| (ii) Centre of vital interest | The country with which his/her personal and economic relations are closer |

| (iii) Habitual abode | The country in which he/she has a habitual abode |

| (iv) Nationality | Country of which he/ she is a national |

| (v)Competent authorities | As determined by mutual agreement between both the countries competent authorities |

The basic rule of taxation of salary income is that salary is taxable in the country where the employee is physically present while rendering services. However, both the ITA and Treaty provide exemption to this basic rule if following specified conditions are satisfied.

Under The Act:

- The Foreign Company is not engaged in any trade or business in India;

- The employees’ stay in India does not exceed 90 days in the previous year AND

- Such salary is not deductible from the income of the employer chargeable to tax in India.

Under the Treaty:

- The expat is present in India for not more than 183 days;

- The salary is paid by an employer who is not a resident in India AND

- The salary is not borne by a permanent establishment in India of the foreign Enterprise.

The conditions would vary depending up on the actual conditions mentioned in the specific treaty with the home country of the expat.

Often foreign Companies deputing their employees on Indian assignments whereby over and above the salary that they pay in their home country, pay Per Diem or Daily Allowance to the employees to compensate for ordinary living charges they have to incur on account of absence from normal place of duty. According to Section 10(14)(i) of The ITA read with

Rule 2BB(1)(b), any ordinary daily allowance paid, while on tour, is exempt from Income

Tax to the extent actually incurred for the purpose of daily living expenditure. The term

“daily allowance” is not defined under the Act but is normally understood to mean boarding, lodging and local conveyance expense incurred in India in this case.

These Allowances are not taxable in India provided the following broad conditions are satisfied:

- Such allowance was paid to enable the employee to meet daily ordinary cost of living in India on account of him/her away from the normal place of duty.

- These allowances are wholly, exclusively and necessarily to meet their personal expenses while on deputation for specific duty.

- A Statement showing detailed daily expenses incurred by them is prepared.

- The employee produces the proof of expenditure spent in India towards such expenses.

- The allowances are “reasonable” having regards to the total Salary and nature of duties performed in India.

STATUTES GOVERNING INCOME TAX ON CROSS BORDER TRANSACTION

- Income Tax Act,

- Foreign Exchange Management (Current Account Transactions) Rules, 2000

- Foreign Exchange Management (Permissible Capital Account Transactions) Regulations, 2000

- Foreign Exchange Management (Borrowing or Lending in Foreign Exchange) Regulations, 2000

- Foreign Exchange Management (Borrowing and Lending in Rupees) Regulations, 2000

- Foreign Exchange Management (Deposit) Regulations, 2016

- Foreign Exchange Management (Acquisition and Transfer of Immovable Property Outside India) Regulations, 2015

- Foreign Exchange Management (Guarantees) Regulations, 2000

- Foreign Exchange Management (Foreign Currency Accounts by a Person Resident in India) Regulations, 2015

- Foreign Exchange Management (Insurance) Regulations, 2015

- Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017

- Foreign Exchange Management (Acquisition and Transfer of Immovable Property in India) Regulations, 2018

- Foreign Exchange Management (Establishment in India of Branch or Office or Other Place of Business) Regulations, 2016

- Foreign Exchange Management (Transfer or Issue of Any Foreign Security) Regulations, 2004

AUTHORITIES UNDER INCOME TAX FOR CROSS BORDER TRANSACTIONS

- Central Board of Direct Taxes

- Authority of advance Ruling under Section 245-O of Income Tax Act, 1961.

- Commissioner of Income-tax under Section 117 of Income Tax Act, 1961

- Director of Income Tax

- National Tax Tribunal established under section 3 of the National Tax Tribunal Act, 2005

- Appellate Tribunal constituted under section 252 of Income Tax Act, 1961

- Assessing Officer under section 120 of Income Tax Act, 1961

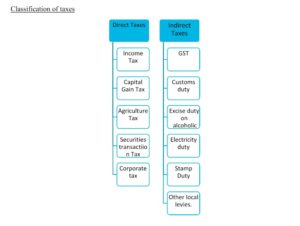

Indirect Tax under International Tax Regime

Indirect international taxes are now catching up to its counterpart to become a big source of income in India. The two main indirect taxes applied to cross border transactions are Customs duty and IGST.

Customs Duty

Customs duty is a form of indirect tax which is imposed at the time of both import and export of goods and services. The tax which is imposed on the import of goods and services are is known as Import duty and for export of goods and services are known as Export duty.

Customs duties are charged almost universally on every good which are imported into a country. These are divided into:

- Basic Customs Duty (BCD)

- Countervailing Duty (CVD)

- Additional Customs Duty or Special CVD

- Protective Duty,

- Anti-dumping Duty

- Education Cess on Custom Duty

Customs duties are computed on a specific or ad valorem basis. In other words, it is calculated on the value of goods. Such value is determined as per the rules laid down in the

Customs Valuation (Determination of Value of Imported Goods) Rules, 2007. If there are doubts regarding the truth or accuracy of the value of goods, valuation of such item is done through the following method:

- Rule 4 & 5 – Comparative value method that compares the transaction value of identical or similar items

- Rule 7 – Deductive value method that uses sale price of such good in the importing country

- Rule 8 – Computed value method that employs costs related to materials, fabrication, and profit in the country of production

- Rule 9 – The Fallback method that is based on previous methods with an element of higher flexibility.

Section 12 of the Customs Act is the charging section. It provides that the duties of customs shall be levied at such rates as may be specified, inter alia, in the Tariff Act. Section 2 of the Tariff Act provides that the rates of duties of customs are specified in the First and Second Schedules. These are commonly referred to as basic customs duties. The First Schedule relates to import duties and the Second Schedule relates to export duties. The First Schedule to the Tariff Act envisages two rates of basic customs duties – standard and preferential. The Tariff Act empowers the Central Government to notify any country or territory to be a “preferential area”. In the case of imports from such notified preferential country or territory, the preferential rate of duty would be levied. The Second Schedule lists out the commodities on which export duty is levied and the rates at which such duty is levied.

To ensure ease of doing business, the CBIC (Central Board of Indirect taxes and Customs), has launched e-SANCHIT, which enables registered persons to file their customs related documents online. The e-SANCHIT initiative is made mandatory from March 15th this year. Only the ICEGATE registered users can use the e-SANCHIT

application by accessing e-SANCHIT link. Under this new scheme, hard copies of the uploaded documents are not required to be produced to the assessing officers. The objective here is to minimize the physical interface between the customs agencies and trade and to maximize the pace of clearance.

LAWS GOVERNING CUSTOMS DUTY-

- Customs Act, 1962

- Customs Tariff Act, 1975

- Customs Valuation (Determination of price of Imported Goods) Rules, 2007

- Customs Valuation (Determination of value of exported Goods) Rules, 2007

- Customs Baggage Rules, 2016

- Customs (furnishing of information) Rukes, 2017

- Customs and Central Excise Drawback Rules, 2017

- Deferred payment of import Duty Rules, 2016

- Customs (Administration of Rules of Origin under Trade Agreements) Rules, 2020 Customs (Advance Rulings) Rules, 2002

- Customs (Appeals) Rules, 1982

- Customs (Attachments of Property of Defaulters for Recovery of Government Dues) Rules, 1995

- Foreign Privileged Persons (Regulation of Customs Privileges) Rules, 1957

- Customs (Compounding of Offences) Rules, 2005

- Customs( Import of Goods at Concessional Rate of Duty for Manufacture of Excisable Goods) Rules, 1996

- Customs (Publication of Names) Rules,1975

- Customs (Settlement of Cases) Rules, 2007

- Customs Tariff (Identification and Assessment of Safeguard Duty) Rules, 1997

- Customs Tariff (Transitional Product Specific Safeguard Duty) Rules, 2002

- Foreign Trade (Regulation) Rules, 1993

- Accessories (Condition) Rules, 1963

- Notice of Short-Export Rules,1963

- Specified Goods (Prevention of Illegal Export) Rules, 1969

- Notified Goods (Prevention of Illegal Import) Rules, 1969

- Denaturing of Spirit Rules, 1972

- Customs Tariff (Identification, Assessment and Collection of Countervailing Duty on Subsidized Articles and for Determination of Injury) Rules, 1995

- Customs Tariff (Identification, Assessment and Collection of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995

- Intellectual Property Rights (Imported Goods) Enforcement Rules, 2007(As amended).

- Publication of Daily Lists of Imports and Exports Rules, 2004

- CEGAT (Countervailing Duty And Anti -Dumping Duty (Procedure) Rules, 1996 AUTHORITIES UNDER CUSTOMS DUTY

- adjudicating authority – authority competent to pass any order or decision under

Customs Act 1962

- Central Board of Indirect Taxes and Customs constituted under the Central Boards of Revenue Act, 1963

- Customs and Excise Appellate Tribunal constituted under section 129 of Customs Act 1962

- Commissioner (Appeals) / Commissioner of Customs (Appeals) under sub-section (1) of section 4 of Customs Act 1962

GST regime

The GST regime of taxation is divided into three parts

- CGST- Central Goods and Services Tax

- SGST/UTGST- State Goods and Services Tax/ Union Territory Goods and Services Tax

- IGST- Integrated Goods and Services Tax

In the international tax regime, IGST is of importance as it is levied on import and export of goods. In cases of export or import of goods or services or when the supply of goods or

services is made to or by a SEZ unit, the transaction is assumed to be Inter-State. In an Inter-State transaction, a seller has to collect IGST from the buyer.

Section 2 (5) of IGST Act, 2017 defines – “Export of Goodsâ€, with its grammatical variations and cognate expressions, means taking out of India to a place outside India.

Section 2 (10) of IGST Act, 2017 defines – “import of goods†with its grammatical variations and cognate expressions, means bringing goods into India from a place outside India.

“Import of Services†as defined under Section 2 (11) of IGST Act, 2017 means the supply of any service, when –

- The supplier of service is located outside India;

- The recipient of service is located in India; and

- The place of supply of service is in India Meaning of Export & Import of Services

“Export of Services†as defined under Section 2 (6) of IGST Act, 2017 means the supply of any service, when –

- The supplier of service is located in India;

- The recipient of service is located outside India;

- The place of supply of service is outside India;

- The payment for such service has been received by the supplier of service in convertible foreign exchange; and

- The supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;

As per provisions of the IGST law import of goods into India shall be deemed to be a supply in the course of inter-State trade or commerce. It has also been provided that Integrated Tax on goods imported into India shall be levied and collected in accordance with the provisions of Section 3 of the Customs Tariff Act, 1975 at the point when duties of Customs are levied on the said goods under the Customs Act, 1962, on a value as determined under the Customs Tariff Act, 1975

The Taxation Laws (Amendment) Act, 2017 provides that IGST on imports will be levied at value of imported article as determined under the Customs Act plus duty of customs and any other sum chargeable in addition to customs duty (excluding GST and GST Cess). This in effect makes levy of IGST at par with present levy of CVD which is on basic value plus customs duty.

As per the definition of ‘supply’ under CGST law, import of services for a consideration whether or not in the course or furtherance of business is deemed to be supply and as per the IGST law, supply of services in the course of import into the territory of India, shall be deemed as supply of services in the course of inter- State trade or commerce. Accordingly, Integrated Tax would be levied on import of services. Although the provisions are yet to be notified, the Integrated Tax on import of services would be payable by the recipient under reverse charge.

Further, there would be no change in applicability of countervailing duty levied under section 9BB of the Customs Tariff Act, 1975 (and different from the additional duty of Customs levied under section 3, ibid., also known as CVD), anti-dumping or safeguard duties, where ever imposed by the Government.

Exports are being zero rated, and therefore input taxes paid would be allowed as refund. However, to determine whether the services qualify as export, it would be important to analyse the conditions prescribed for “export of serviceâ€.

The definition of “export of service†is similar to the present law, and therefore no new conditions are prescribed. However, place of supply rules would need to be evaluated on a case-to-case basis to determine the tax applicability on such services.

The default rule for place of supply for export of service shall be the location of the service recipient, where the address on record of the recipient exists with the exporter. Hence, it will be critical for exporters to ensure that the address of service recipient on record can be established before the authorities on request.

STATUTES GOVERNING IGST

- IGST Act, 2017

- CGST Act, 2017

- Customs Tariff Act, 1975

- IGST Rules, 2017

AUTHORITIES UNDER IGST

- adjudicating authority – authority competent to pass any order or decision under CGST Act, 2017

- Central Board of Indirect Taxes and Customs constituted under the Central Boards of Revenue Act, 1963

- Authority of advanced Ruling

- Appellate Authority of Advance Ruling under section 107 of CGST Act, 2017

- Appellate Tribunal under section 109 of CGST Act, 2017

Disclaimer – Above article is prepared by Astrea Legal Associates Team member Ms. Anjali Rautela conducted research in association of team Astrea Legal headed by Mr. Manish Modak, Partner. The publication is prepared and published as general information and shall not be relied upon to constitute any legal opinion. All readers are requested to consult legal expertise only. This publication is provided for general information and does not constitute any legal opinion. This publication is protected by copyright. © 2017 Astrea Legal Associates LLP.