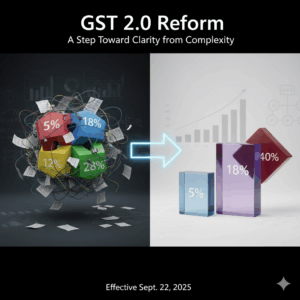

“GST 2.0 Reform: A Step Toward Clarity from Complexity”

INDIA’S GST 2.0 REFORMS (EFFECTIVE SEPTEMBER 22, 2025)

The original Goods and Services Tax (GST), implemented in 2017, aimed to create a unified indirect tax system. However, multiple tax slabs (5%, 12%, 18%, 28%) led to classification disputes and compliance challenges. Essential goods remained relatively expensive, affecting lower- and middle-income households. Recognizing these issues, the Government of India introduced the GST 2.0 reforms, effective from September 22, 2025, to simplify the tax structure and make it more equitable.

Understanding of the Issue:

GST 2.0 rationalizes taxation by reducing slabs to three:

5% for essential items like food, medicines, and education supplies

18% for standard goods and services

40% for luxury and harmful goods

This restructuring is aimed at reducing complexity, improving transparency, and ensuring that taxation aligns with both social welfare and economic growth objectives.

Legal Implications:

The legal implications of GST 2.0 reforms include simplified compliance due to fewer tax slabs, reducing disputes and easing audits under the CGST Act. Anti-evasion measures are strengthened by stricter time-of-supply regulations and the Input Tax Credit, which clearly penalise noncompliance. Businesses need to update their contracts and pricing to reflect the new rates, which may result in new lawsuits and temporary legal changes. By improving tax certainty and transparency and enabling flexible government regulation through notifications, the reforms create a stable legal environment that promotes economic growth.

Benefits:

The ability of the GST 2.0 reforms to streamline and update India’s indirect tax structure is what gives them legal advantages. The reforms reduce the number of tax slabs, which reduces classification and rate disputes and facilitates compliance for both individuals and businesses. A more transparent tax environment is produced and litigation risks are decreased by the more straightforward regulations and expedited procedures, such as quicker refunds and automated filing. Through enhanced input tax credit controls, this legal clarity reduces tax evasion and promotes better enforcement of tax laws. The system is ultimately more equitable and effective

for all parties involved, thanks to GST 2.0’s balanced and predictable legal framework, which encourages economic growth while reducing the tax burden on consumers and small businesses.

Process:

The Ministry of Finance will announce the updated regulations that will be used to carry out the reforms. Companies need to update their invoices, reclassify their products in accordance with the new slabs, and fulfil their reporting and auditing requirements. It is assumed that public awareness initiatives will facilitate a seamless transition and enforcement.

Conclusion:

A major policy change, GST 2.0 addresses social justice and economic growth while streamlining taxes. It is a step in the right direction towards a more effective and inclusive tax system, but its success will rely on stakeholder cooperation, legal clarity, and efficient enforcement.

________________________

Astrea Legal Associates LLP

Contributed by : Ishika Fatnani/ Prathibha Madagouni

www.astrealegal.com

Note: This publication is provided for general information and does not constitute any legal opinion.This publication is protected by copyright. © 2025,Astrea Legal Associates LLP