View PDF

Business Opportunities for NRIs / PIOs in India

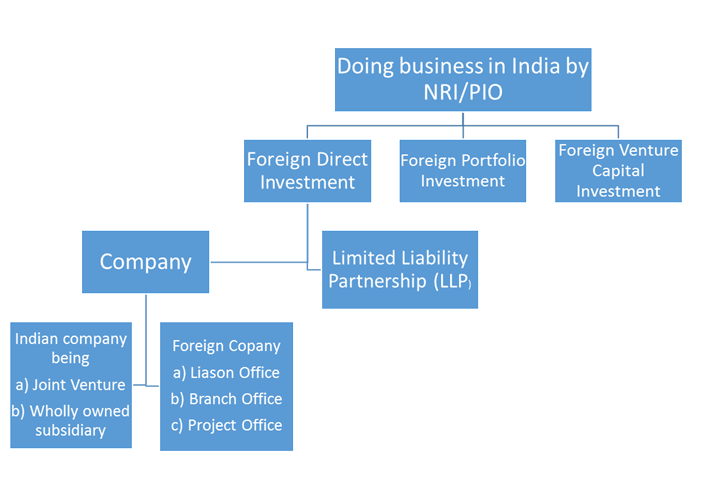

Investing in India while living abroad has always been a reliable strategy for ensuring financial growth and securing future returns. The Indian government has played a proactive role in addressing the investment needs of non-resident investors. However, when doing business or investing in India, it is crucial to comply with various regulations right from the beginning. Therefore, it is advisable to seek professional guidance to ensure compliance with government requirements.

STEP 1:Check the FIBP policy

FIBP (Foreign Investment Promotion Board) is the authority that regulates foreign investment in India. Before starting a venture the foreign investor must ensure that the investment falls in the permissible category of FDI (Foreign Direct Investment). FDI can be categorised into:-

- Businesses where FDI is not allowed at all

- Businesses where FDI is allowed by approval of the Govt i.e Govt. route

- Businesses where no prior approval is required from FDI i.e Automatic route

STEP 2:Select the type of Venture

LLP

As per FDI Policy, FDI in LLP is allowed only through Government route, FDI in LLP under automatic route is not permissible.

Further FDI in LLP through Government route is allowed to only those sectors where 100% FDI is allowed under automatic route under the FDI policy.

Joint Venture:

When two parties (an NRI firm along with a firm in India) agree to combine or cooperate their business in a specific and limited way and thereby incorporate a new company in India, it is known as a Joint Venture.

For an NRI and his/her business, a strategic alliance in the form of a JV with one or more Indian partners can be made in the following 3 types of formats:

- Incorporating a new company in India where business of one party is transferred to this company and shares issued by the company against it. The firm subscribes to these shares against the transfer of its business while the other party subscribes to the shares in cash.

- Setting up a separate joint venture business (possibly in the form of a new company) to work on a specific contract where the parties own shares in a pre-agreed proportion and also agree on terms of how the business is to be arranged between them.

- Promoter share holder of an existing Indian firm along with a third party cooperating and collaborating in order to jointly carry on the company business where the shares are bought by this third party in cash.

Wholly Owned Subsidiary

Wholly owned subsidiaries refer to Indian companies that are wholly owned, controlled and managed by foreign capital. Thus, incorporating a wholly owned subsidiary by an NRI is only possible in sectors where 100% FDI (Foreign Direct Investment is allowed).

Liaison Office:

A Liaison office is nothing but an important node in the channel of communication between the head quarter of a foreign company at its principle place of business with its Indian entities. Thus, a liaison office set up in India cannot undertake any commercial activity in order to earn income.

Project Office:

A project / site office is set up to specifically execute a project of the foreign company in India. This is thus temporary in nature and lasts till the time the project is fully executed. The approval for setting up a project Office in India by an NRI is given by the RBI subject to specified conditions. A Project Office cannot undertake any other activity that is not related to the specified project execution.

Branch Office:

As an NRI / PIO, you can set up a branch Office in India for foreign companies which are engaged in manufacturing and trading operations. This Branch Office in India cannot undertake manufacturing operations on its own but subcontracts the same to Indian manufacturers. Setting up a branch office by an NRI requires RBI approval and usually such offices have the permission to remit the profit earned from India back to the foreign country after payment of necessary Indian taxes.

Foreign portfolio investment

NRIs/PIOs can invest in shares of Indian companies i.e (Portfolio Investment Scheme) upto 5% of the paid up capital of the company. The limit can be raised by a General Body Resolution of the Company.

Step 3: Open a Bank account

There are schemes which deals with various types of bank account facilities available to NRIs or PIOs, which are as follows:-

- Non-Resident (External) Rupee Account Scheme (NRE Account) –

Under this scheme, NRIs and PIOs are eligible to open NRE Accounts with authorized banks in India. These accounts are convertible foreign currency accounts designated in Indian rupees and can be maintained in the form of savings, current or term deposit accounts. For opening such accounts, funds are required to be remitted to India through any bank from the country of residence of the prospective account holder. Opening of joint accounts with other NRIs/ PIOs is also permissible. Non-residents can enjoy the following benefits by maintaining NRE Accounts:- (i) term deposit for one year and above made by non-residents carry interest at higher rates than those available to residents in India; (ii) interest on deposits and any other income accruing on the balances in the accounts are free of Indian income tax; (iii) balances in the accounts are free of wealth-tax; (iv) gifts out of NRE account to close relatives are exempt; (v) entire credit balance (inclusive of interest earned thereon) can be repatriated outside India at any time without reference to Reserve Bank; (vi) local disbursement from these accounts can be made freely; (vii) account holders can avail of loans/ overdrafts from banks against security of fixed deposits from out of their NRE accounts; etc.

- Foreign Currency (Non-resident) Account (Banks) Scheme (FCNRB) –

Under this scheme, NRIs are eligible to open and maintain FCNR accounts with authorised dealer. However, opening up of such accounts by individuals/ entities of Bangladesh/ Pakistan nationality/ ownership requires prior approval of Reserve Bank. Accounts can be opened with funds remitted from outside India through normal banking channels or funds received in rupees by debit to account of a non-resident bank maintained with authorised dealer in India or funds which are of repatriable nature in terms of regulations made by Reserve Bank. They can also be opened by transfer of funds from existing NRE/FCNR accounts. Further, FCNR(B) account can only be opened in the form of term deposits.

- Non-resident Ordinary Rupee (NRO) Account Scheme –

Under this scheme, any person resident outside India may open NRO account with an authorised dealer or an authorised bank for the purpose of putting through bonafide transactions denominated in Rupees, not involving any violation of FEMA rules and regulations made thereunder. However, opening up of accounts by individuals/ entities of Bangladesh/ Pakistan nationality/ ownership requires prior approval of Reserve Bank. NRO Accounts may be opened and maintained in the form of current, savings, recurring or fixed deposit accounts. The accounts may be held jointly with residents and/ or with non-residents. Besides, NRO Account (Current/ Savings) can be opened by a foreign national of non-Indian origin visiting India, with funds remitted from outside India through banking channel or by sale of foreign exchange brought by him to India.

Permissible Credits / Debits to NRO account are as follows:

Credits

- Proceeds of remittances from outside India through normal banking channels received in foreign currency which is freely convertible.

- Any foreign currency, which is freely convertible, tendered by the account holder during his temporary visit to India.

iii. Transfers from rupee accounts of non-resident banks.

- Legitimate dues in India of the account holder. This includes current income like rent, dividend, pension, interest, etc.

- Sale proceeds of assets including immovable property acquired out of rupee/foreign currency funds or by way of legacy/inheritance.

- Resident individual may make a rupee gift to a NRI/PIO (NRO account holder) who is a close relative of the resident individual by way of crossed cheque /electronic transfer. The gift amount would be within the overall limit of USD 75,000 per financial year.

vii. Resident individual may lend to a Non resident Indian (NRI)/ Person of Indian Origin close relative (NRO Account Holder) by way of crossed cheque /electronic transfer, subject to conditions within the overall limit of USD 75,000 per financial year.

- Debits

- All local payments in rupees including payments for investments in India subject to compliance with the relevant regulations made by the Reserve Bank.

- Remittance outside India of current income like rent, dividend, pension, interest, etc. in India of the account holder.

iii. Remittance up to USD one million, per financial year, for all bona fide purposes.

- Transfer to NRE account of NRI within the overall ceiling of USD one million per financial year subject to payment of tax, as applicable.

Step 4: special Govt approvals if any

NRIs/PIOs do not have to seek specific permission for approved activities covered under ‘General Permission’ schemes. The activities relating to NRIs/PIOs not covered under those schemes either require declaration to RBI or permission from RBI. The activities requiring Declaration/Permission along with corresponding forms are as under:

FCTRS— Transfer of Shares/Debentures by Non-residents to Residents and by Residents to Non-residents FNC 1– Permission to establish a branch office in India by an Overseas Company, establishing a Representative Office by Overseas Company for Liaison Activities, to open a Project/Site Office in India